The future of stock market investing with AI-driven tools holds unparalleled potential for both institutional and retail investors. By enabling granular data analysis, personalized investment strategies, improved risk management, and sentiment analysis, AI fundamentally changes how investors engage with the market. As Jonathan Taylor, a market strategist, summarized, “AI’s impact on stock investing is not about eliminating human decision-making but about enhancing it.” In this AI-powered landscape, investors who embrace the technology will have access to insights and strategies that were once considered unattainable, setting the stage for a more informed, data-driven future.

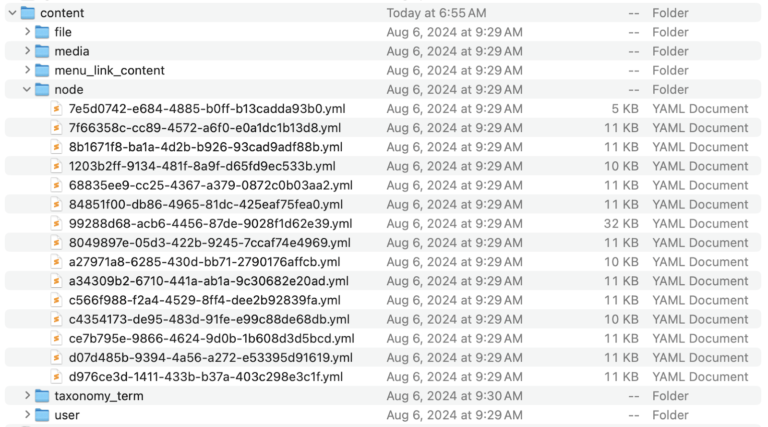

Enhanced Capacity to Analyze Large Datasets

In 2024, artificial intelligence (AI) is fundamentally reshaping stock market investing and risk management by providing traders and analysts with a range of advanced tools and techniques. These tools enable deeper and more nuanced insights into the dynamics of the stock market. “AI is not just about automating processes; it’s about empowering investors to see and act on patterns that humans alone would miss,” said Alex Green, a leading quantitative analyst at a major investment firm.

Risk management, once a painstakingly manual process requiring complex calculations, is now aided by AI’s ability to quickly analyze data and surface correlations. For example, AI can identify sector-specific risks, correlations among seemingly unrelated assets, or the impact of macroeconomic events on portfolio performance. “AI helps us see risk from a macro perspective while diving deep into micro-level exposure,” explained Mark Stein, a portfolio manager.

Robo-Advisors Revolutionizing Investment Advice

As investors continue to engage with the market through traditional and AI-driven channels, effective risk management remains paramount. AI greatly enhances risk management processes by highlighting potential risk concentrations that would otherwise remain latent and unmanaged. For example, an index-tracking fund designed to mirror a broad index like the S&P 500 could become overly concentrated in a particular sector if that sector experiences rapid appreciation. This occurred in 2021 when the index became heavily skewed toward tech stocks. Similarly, energy stocks dominated the index around 2010. AI algorithms can automatically detect these shifts and alert investors to potential risks, helping them maintain balanced portfolios.

The convenience and accessibility of robo-advisors have empowered a broader audience to engage in the market with greater confidence. “Robo-advisors make sophisticated wealth management accessible to everyone, not just the wealthy elite,” noted Jamie Lu, a financial expert. This democratization of investing ensures that more people can benefit from advanced AI-driven insights without the need for extensive market knowledge or high fees.

Improved Risk Management with AI

Another area where AI is transforming stock market engagement is through natural language processing (NLP). AI’s NLP capabilities have revolutionized how analysts interpret news articles, earnings call transcripts, and other text-based data sources. Historically, large-scale text analysis relied on rudimentary keyword searches, making it impossible to systematically extract deeper insights. Today, advanced NLP models can analyze huge volumes of textual data from earnings calls to detect issues like potential deception, hesitation, or a lack of confidence in a company’s prospects. This capability was previously unattainable through human effort alone.

NLP, when combined with big data processing technologies like Hadoop, can also monitor and analyze live sentiment data from sources like social media. By ingesting large streams of user-generated content, AI algorithms can generate real-time signals that provide insights into a company’s public perception or market trends. “The ability to instantly gauge public sentiment on a company or product gives traders a significant edge in making informed decisions,” remarked Dr. Elena Perez, an AI researcher.

Natural Language Processing (NLP) and Sentiment Analysis

One of the most significant impacts of AI on stock market investing is its ability to ingest and analyze vast volumes of stock data with remarkable granularity, often down to individual trade resolutions. Before the advent of neural networks and AI, analysis tools relied on aggregated data over fixed intervals, such as five-minute periods, to create ‘bars’ that represented open, high, low, and close prices. While this made computations more manageable, it often concealed crucial market dynamics. For example, a sudden surge of small, individual trades could signal retail investors attempting to squeeze a short position in a stock—a movement potentially visible in individual trades but obscured in aggregated bar data. “With AI-driven analysis, we no longer lose the granular signals hidden within large datasets,” noted Priya Menon, a data scientist specializing in market trends.

The power of AI doesn’t stop at market analysis; it extends into how individuals manage their personal investments. AI-powered robo-advisors are democratizing investment management by providing personalized portfolio recommendations tailored to an individual’s financial goals, risk tolerance, and market conditions. These platforms leverage machine learning algorithms to construct and automatically rebalance portfolios, optimize asset allocation, and provide tax-efficient trading strategies, such as tax-loss harvesting. For instance, users can benefit from automated adjustments during market downturns to minimize tax liabilities while maintaining growth potential.

A Future of Unparalleled Insights

This capacity for granular analysis allows traders to better identify emerging patterns and anomalies that could impact market behavior. For example, AI can flag unusual trading volume that might indicate insider information, or it can detect a sudden increase in trading activity around earnings reports. By making these complex patterns more visible, AI enables quicker, more informed responses that are crucial in fast-moving financial markets.

By Gary Bernstein