Nov 26, 2025

Shoppers are heading into Black Friday 2025 feeling more cautious about their spending than in 2024. Although incomes and spending are up, growth is slow, and renewed inflation is forcing households to be more selective. We’ll look at four key charts covering consumer spending, inflation, online prices, and ecommerce sales to compare this year with the last.

Here’s what the data shows:

- Overall spending growth is slowing, indicating a shift toward more selective, deal-focused shoppers.

- Rising inflation for essentials is squeezing budgets for discretionary items.

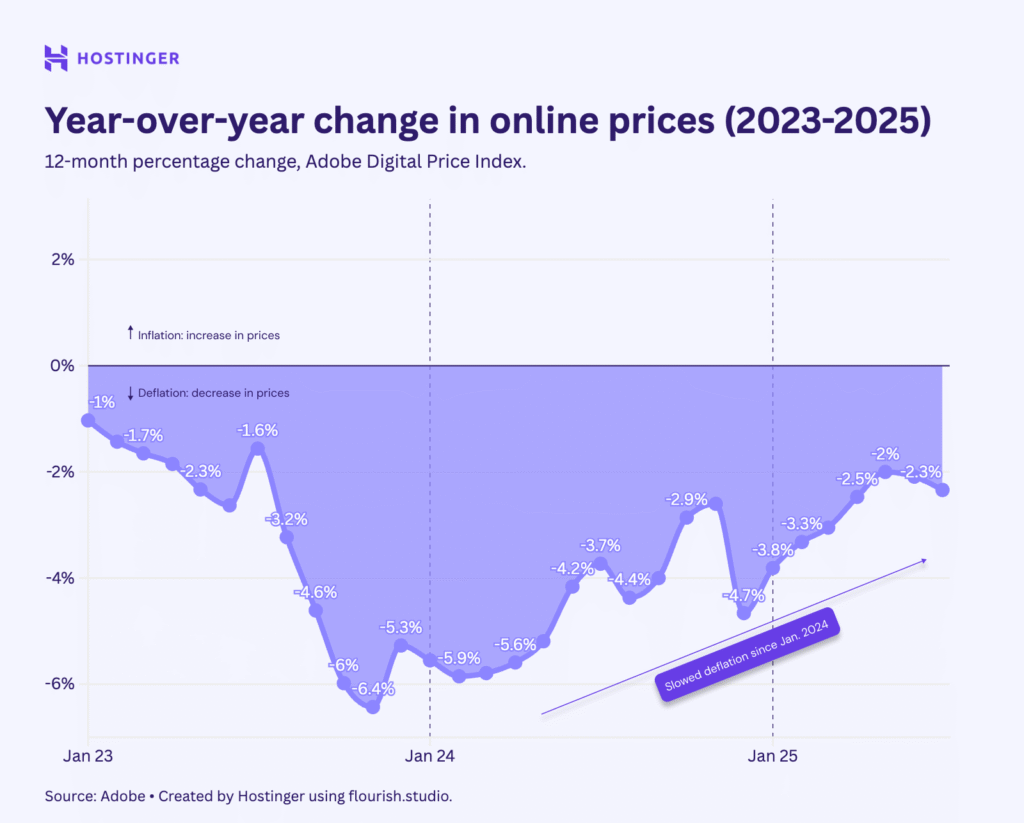

- Online prices are still dropping, but more slowly than last year.

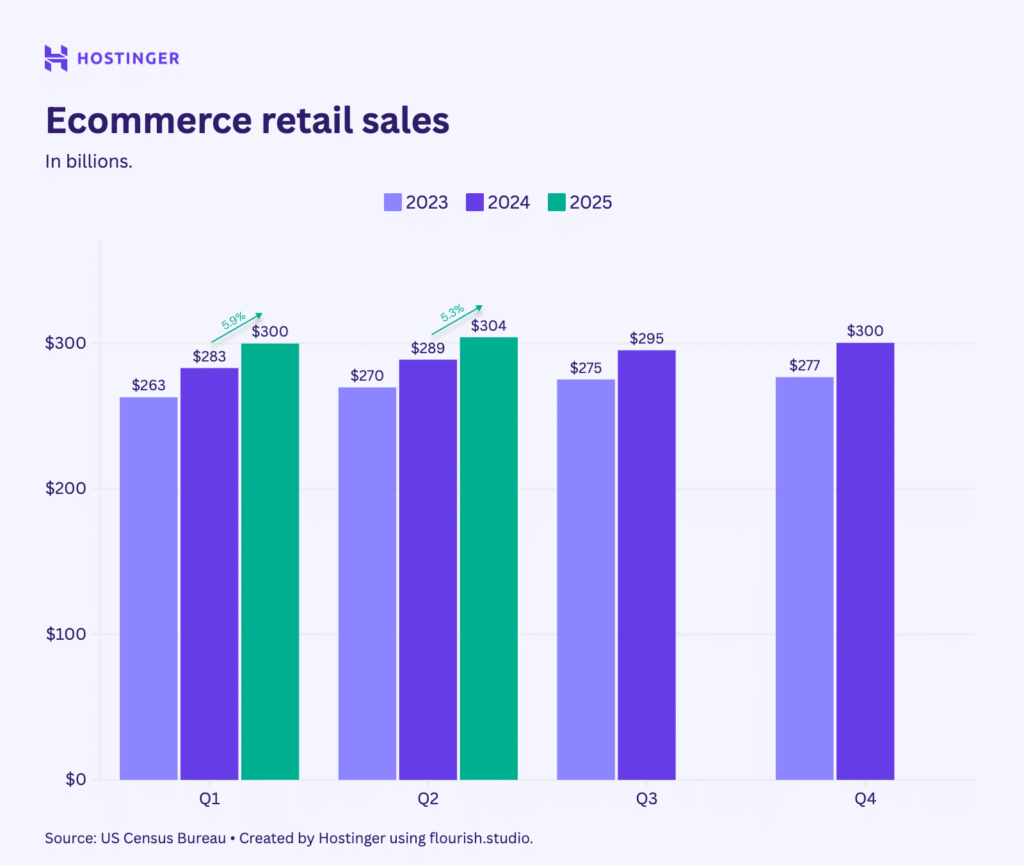

- Ecommerce sales growth is accelerating, leading to increased online competition.

Are people earning and spending more?

These charts show that while both personal income and spending increased in 2025, their growth rates are slower compared to 2024. Spending also grew faster than income in recent months (like August 2025, when spending jumped $129.2 billion while income rose $95.7 billion), suggesting people may be dipping into savings.

“The data shows spending outpacing income, which strongly suggests consumers are tapping into their savings. This changes the game for retailers. Shoppers aren’t just looking for a deal, they’re looking for the deal that justifies dipping into their reserves. Superficial discounts will likely be ignored in favor of clear, high-value offers”, explains Patrick Burke, US & UK Country Manager at Hostinger.

The 2025 Black Friday takeaway: This suggests shoppers will be hunting for deep discounts rather than making impulse buys. For your business, this means “nice to have” items will be a harder sell, so focus your promotions on your most popular products or high-value bundles.

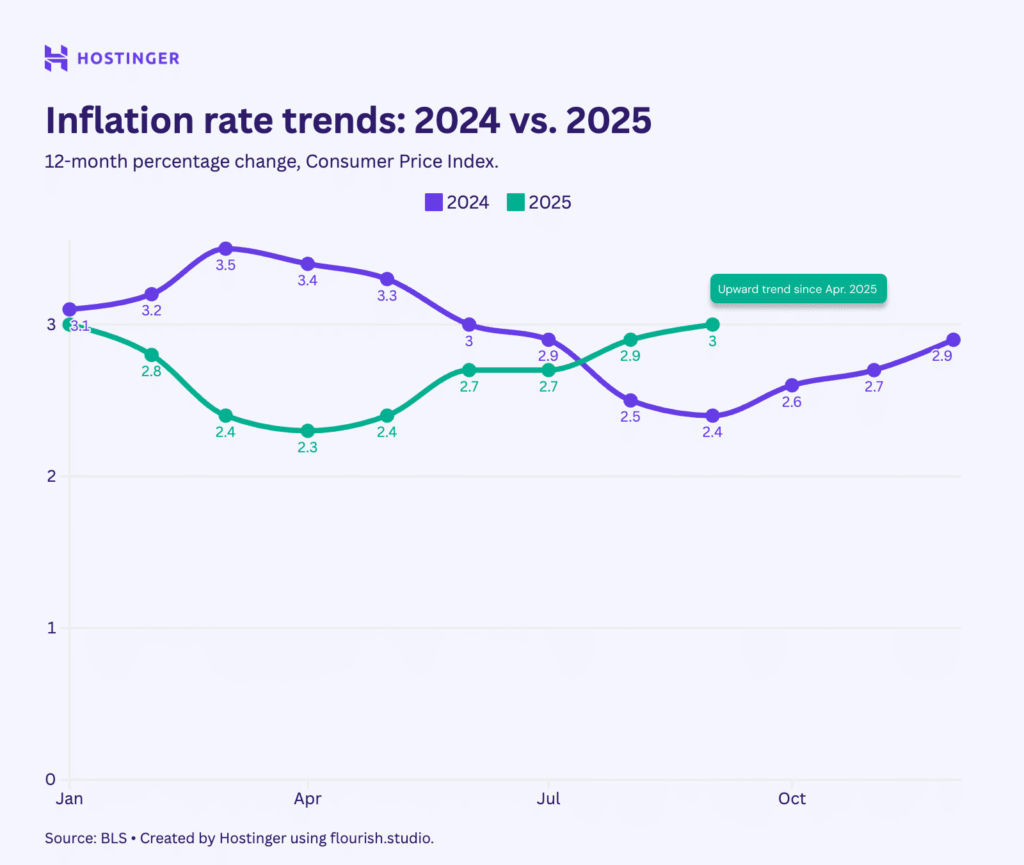

How is inflation shaping shopper budgets?

After inflation rates cooled in the spring of 2025 (dropping to 2.3% in April), they have trended back upward toward 3% by September. This contrasts with 2024, during which inflation rates gradually declined during the same period.

The 2025 Black Friday takeaway: Expect value and necessity to be the key themes for shoppers this year. They’ll be prioritizing essentials, so if you sell discretionary goods, you’ll need significant markdowns to capture their limited funds.

What’s happening with online prices?

Online prices are still lower than they were last year, but those price drops are shrinking, according to the Adobe Digital Price Index. After falling sharply in 2023, the rate of deflation has slowed. For example, while year-over-year prices were down 5.8% in January 2024, that price drop had shrunk to just 2.3% by July 2025.

“We’re seeing a clear stabilization in online prices; the dramatic deflationary drops of the last two years are slowing. This creates a tough situation where shopper expectations for massive deals remain high, but retailers have less pricing flexibility. Businesses will need to win on perceived value and smart bundles, not just a race-to-the-bottom price tag”, Burke adds.

The 2025 Black Friday takeaway: Don’t try to match 2024’s discount depths – you can’t. Instead, emphasize value beyond price: bundle products, offer free expedited shipping, or create scarcity with limited quantities.

Are more people shopping online?

Ecommerce sales continue to grow steadily. In Q1 2025, ecommerce sales reached $299 billion (up 5.9% year-over-year from Q1 2024’s $283 billion). By Q2 2025, sales hit $304 billion (up 5.3% from Q2 2024’s $288 billion). According to the US Census Bureau, ecommerce now represents 16.3% of total retail sales, its highest point since the 2020 pandemic surge.

“Ecommerce’s share of total retail is at its highest point since the 2020 surge, and growth is accelerating. This means the online marketplace is incredibly crowded. For Black Friday, site performance and a frictionless user experience aren’t just optimizations, they are the primary battleground for conversion”, states Burke.

The 2025 Black Friday takeaway: Competition for online customers will intensify as more shoppers opt for digital purchases. Your online store’s performance and user experience will be critical to converting traffic when so many other options are available.

What this means for your 2025 Black Friday strategy

These four trends paint a clear picture of the 2025 shoppers: they are more cautious, their budgets are tighter due to inflation, and they are shopping online more than ever.

The 2025 shoppers are resourceful and more patient. They have less spending power (due to inflation) but still expect great deals (from seeing online prices fall). They are also more comfortable shopping online, meaning they can compare prices across dozens of competitors instantly.

For businesses, this means early deals, clear pricing, and a focus on real value will be essential. Don’t wait for Black Friday itself; capture budget-conscious shoppers early with promotions that clearly show the savings on items they truly need or want.

All of the tutorial content on this website is subject to

Hostinger’s rigorous editorial standards and values.