What Is FinOps?

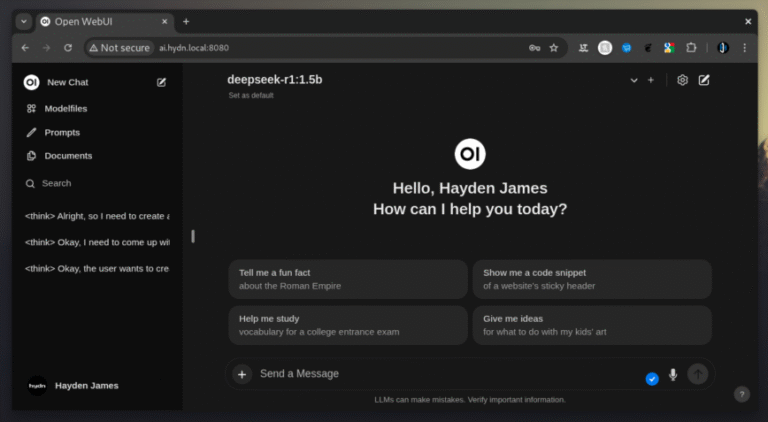

Advanced forecasting algorithms analyze historical spending data to project future expenses under various operational scenarios, aiding in risk assessment and resource allocation. Such predictive capabilities are crucial for anticipating financial needs and responding to changes in business dynamics.

When selecting a FinOps tool, it’s crucial to ensure that it seamlessly integrates with the existing IT infrastructure. This compatibility reduces the need for extensive modifications or replacements within current systems, which can be costly and disruptive. FinOps tools should support integration with a range of cloud platforms and services, as well as with on-premises systems where necessary.

Challenges in Cloud Financial Management

FinOps tools enhance the efficiency of financial operations by automating the tracking and reporting of cloud expenditures. They aggregate cost data from various cloud services and platforms, presenting it within an intuitive dashboard. This consolidation enables a comprehensive view of all cloud-related expenses, assisting organizations in maintaining an up-to-date and accurate financial oversight.

Variable and Unpredictable Costs

The effectiveness of FinOps tools is largely determined by the richness of features they offer. A comprehensive tool should include capabilities such as detailed cost analysis, budgeting, forecasting, and cost optimization recommendations. It should also provide features for governance and compliance monitoring to ensure that cloud spending aligns with company policies and regulatory requirements.

This could involve custom dashboards, specific alert thresholds, or unique reporting formats. Tools that are easy to use and customize can improve efficiency and enhance user adoption and satisfaction.

Lack of Clarity and Granularity in Cloud Billing

Adopting FinOps practices and tools is increasingly crucial as organizations expand their reliance on cloud technologies. The challenges of managing cloud finances—ranging from unpredictable costs to complex billing and allocation issues—demand a strategic approach that these tools provide.

This ensures that data across different environments can be consolidated effectively for analysis and management. Additionally, tools that offer APIs for integration help in creating a more cohesive and flexible operational framework, which can adapt to future technology changes or business needs.

Difficulty in Allocating Cloud Costs to Specific Departments

The goal of FinOps is to empower teams to make better decisions about cloud resource usage. It involves monitoring, measuring, and making trade-offs regarding cloud spend, ensuring transparency across departments and aligning costs with business outcomes.

It’s important to ensure that all stakeholders, from IT to financial teams, can effectively utilize the FinOps tool. User-friendly interfaces, clear navigation, and accessible reporting features make it easier for users to find the information they need and make informed decisions. Customization options allow the tool to be tailored to the requirements of the organization.

How FinOps Tools Help with Cloud Costs

As organizations grow, their cloud infrastructure and associated costs become more complex. The chosen FinOps tool must be able to scale accordingly, handling increased volumes of data and more complex cost structures without performance degradation.

Automated Cost Tracking and Reporting Features

Organizations can leverage FinOps tools to achieve the following capabilities.

Features such as automated alerts and detailed cost breakdowns allow for the early detection of anomalies and spending trends, facilitating proactive management of resources. The automation of these processes saves time and reduces the potential for human error, ensuring that financial data is reliable and readily available for strategic decision-making.

Budget Management and Forecasting Capabilities

The ability to make these recommendations in real time enables organizations to quickly adapt to changes in demand and operational conditions, avoiding unnecessary expenses. This proactive approach to cost management is crucial for maintaining competitive advantage and achieving long-term financial sustainability in the cloud.

Cloud billing can often be complex and lacking in detail, making it difficult for businesses to understand exactly what they’re being charged for. This lack of transparency can prevent effective cost management and optimization, as organizations are unable to pinpoint areas where spending could be reduced.

Real-Time Cost Optimization Suggestions

Advanced analytics and machine learning features can further enhance the tool’s ability to predict trends and provide insights. The availability of customizable alerts and reports is also useful for catering to the needs of different stakeholders within the organization.

By implementing effective FinOps tools, organizations can benefit from automated cost tracking, sophisticated budget management, and real-time optimization recommendations. Such tools foster financial transparency and accountability while also enhancing operational efficiency and strategic agility.

Choosing the Right FinOps Tools

Budget management and forecasting features within FinOps tools enable effective financial planning. These tools enable organizations to establish detailed budgets for different departments or projects, closely aligning expenditure with strategic business goals.

Compatibility with Existing Infrastructure

By Gilad David Maayan

This includes the ability to manage multiple cloud accounts and services. Scalable tools ensure that as the business expands or shifts its strategy, the financial operations can continue without interruption and without the need for frequent tool upgrades or replacements.

Feature Set

FinOps, or Financial Operations, is a business strategy for managing cloud spending and optimizing the costs associated with cloud services. It combines financial, business, and IT principles to create a balanced approach that ensures cloud expenses are controlled without hindering agility and growth.

Cloud services are known for their elasticity, which, while beneficial for scaling operations, also makes financial management unpredictable. Costs can fluctuate dramatically based on changing workloads, leading to challenges in budgeting and financial planning. Without a predictive cost model, organizations often encounter unexpected expenditures that can impact their profitability.

Scalability

A further issue is the granularity of billing statements, which may not provide sufficient detail to analyze costs thoroughly. Organizations require a breakdown of expenses by service, region, or even hour to accurately allocate costs and identify savings.

Here are some of the main challenges associated with managing finances in the cloud.

Ease of Use and Customization

Without clear cost allocation, departments may not be incentivized to optimize their resource use. This potentially leads to wastage or suboptimal deployment of cloud resources, impacting overall financial efficiency.

Here are some considerations when evaluating FinOps solutions.

Conclusion

The pay-as-you-go model of cloud computing, although flexible, complicates cost forecasting. Usage spikes or unconventional demand can result in significant unbudgeted expenses, posing a challenge for financial teams to maintain control over budgets.

The dynamic nature of cloud computing requires tools that can not only track spending but also suggest immediate cost-saving measures. FinOps tools analyze ongoing usage and expenditure to offer actionable recommendations for cost optimization. These suggestions may include reallocating resources, switching to more economical service plans, or terminating redundant services.

Allocating cloud costs to specific departments or projects is complicated due to the shared nature of cloud resources. Without proper financial tools and methodologies, establishing accountability and fair chargeback practices is problematic, leading to potential conflicts or mismanagement of resources.